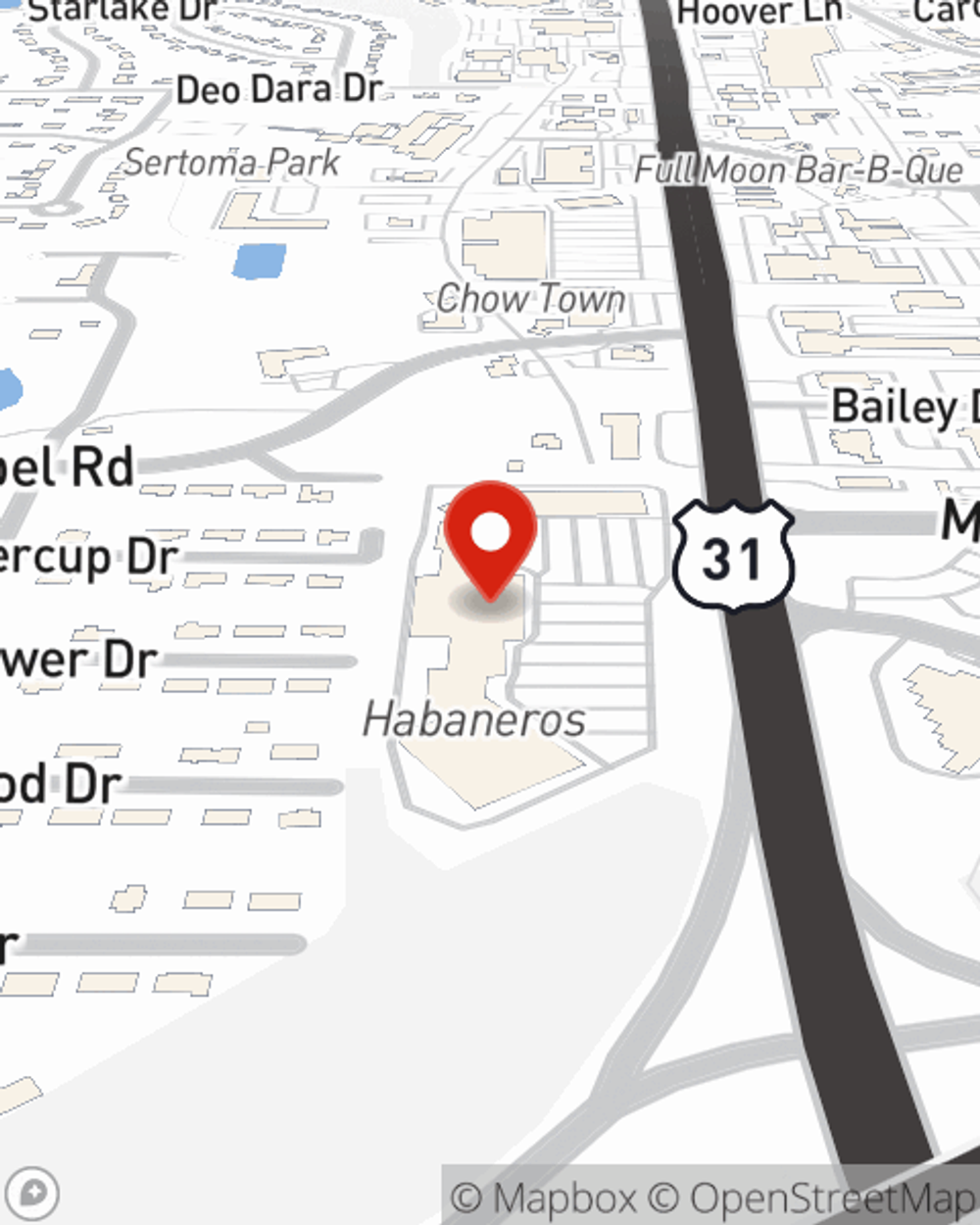

Business Insurance in and around Hoover

One of Hoover’s top choices for small business insurance.

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Johnny Poole help you learn about your business insurance.

One of Hoover’s top choices for small business insurance.

Insure your business, intentionally

Strictly Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a painter or an optometrist or you own a bicycle shop or an art gallery. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Johnny Poole. Johnny Poole is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Get in touch with State Farm agent Johnny Poole's team today to explore the options that may be right for you.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Johnny Poole

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.